How Your Behavioral Health Facility Can Navigate In-Network Contracts

How-to Navigate Payor Contracts

The process of going in-network can be lengthy and complicated. But since going in-network is becoming more financially feasible for behavioral health facilities, it’s worth your time to really understand the process and negotiate for the right rates.

Learn the pros and cons of going in-network

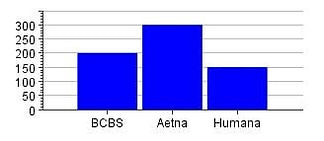

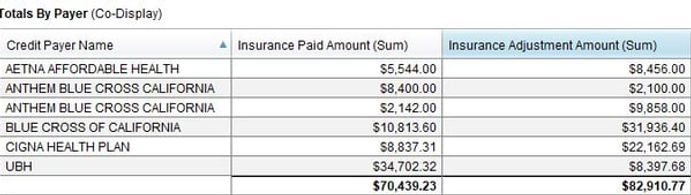

First, you need to determine which payors you’d like to enter a contract with. You’ll need to consider what percentage of revenue you currently bring in from each insurance plan and the average of what those plans currently reimburse for out-of-network services. Many billing softwares generate these reports with analytics like the one below.

After you’ve chosen which payor you’d like to be in-network with, you’ll need to start a pre-application by calling the insurance company or filling out an online form. To save you time down the road, make sure you meet basic requirements for credentialing.

Next, you’ll fill out the application online. Many insurance companies use the Council for Affordable Quality Healthcare (CAQH) ProView application. This application can be submitted to multiple payors at once, saving you time. You’ll need items such as:

- State medical license

- Drug Enforcement Agency certificate

- Controlled dangerous substance certificate

- Malpractice insurance

After your application is complete, the credentialing process begins. This part of the process can take up to two months. During this time, the insurance company verifies you have the qualifications, services and experience to serve their clients.

Click to read how going in network could increase your revenue.

What Your Payor Contract Will Include

Finally, it’s time to negotiate your payor contract. Your payor contract will outline several items you need to pay attention to:

- Reimbursement rates and policies for each service

- How long you have to submit a claim after a service

- The number of days the payor has to reimburse for services

- The list of services covered by the payor

- How to dispute a claim denial

- How long the contract will last

- How much notice either party has to give before renegotiating or terminating the contract

It is important to consider each of these items and how they will impact your practice. Only focusing on reimbursement rates can cause problems in the future, especially if the contract includes unilateral amendments, allowing the payor to change reimbursement without warning, or complicated reimbursement policies that result in denied claims. While reimbursement rates are likely your top concern, carefully read through the entire contract.

How to Negotiate Reimbursement Rates

As you determine appropriate reimbursement rates, you need to work closely with your financial team to analyze the amount of money you make from each payor and what impact they each have on your revenue. You’ll want to know what you typically get paid for services and what you need to get paid to reach revenue goals. For instance, if a single payor covers more than half of your patients, it is more important to negotiate higher rates with that payor than with one that covers just 5 percent of your patients.

Rates vary depending the size of your practice, your location and patient demographic. When you are negotiating, be sure to provide financial proof you need higher reimbursement rates. You’ll need to show the cost of the services you provide each day for your patients and why your services are helping the population you serve. Any case you make that shows the payor that your services are effective and necessary, the more likely you are to receive a higher rate.

Value-Based Care

Insurance companies are moving to more value-based care initiatives. These initiatives reimburse providers for outcomes, not services. Insurers more frequently will want to know if their patients need different care for better outcomes—and may be more likely to reimburse higher for that care if you can prove patients will benefit.

By working with your financial team to review your practice’s analytics, you’ll be able to create a plan that improves your bottom line.

Whether or not you have a financial team, negotiating a payor contract is easier with experienced experts on your side. Contact Datapro to begin the contracting process or to schedule a consultation.

CONTACT US

We help healthcare providers and facilities to optimize their finances and manage insurance billing so they can focus on high-quality care while maintaining confidence in their bottom line.

APPLY TO WORK TOGETHER

© aurora-hcs.com | All rights reserved | Created with Heart, Soul, & Strategy by Elise Cruz Company